Today, February 24, 2025, marks exactly three years since the Russian invasion of Ukraine. This event has profoundly impacted not only the history of our time but also global geopolitics and the way we live. The human suffering, destruction, and uncertainty that followed this conflict are difficult to measure, but the world did not stop. Global economies, investors, and financial markets have continued to evolve, adapting to a situation that initially seemed impossible to predict.

Today, we want to reflect on what these three years have taught us. Not only about political and military dynamics but also about how such significant geopolitical events can influence financial markets, and, most importantly, how we can draw lessons from history to face future uncertainties.

The Stock Market’s Reaction to Geopolitical Shocks

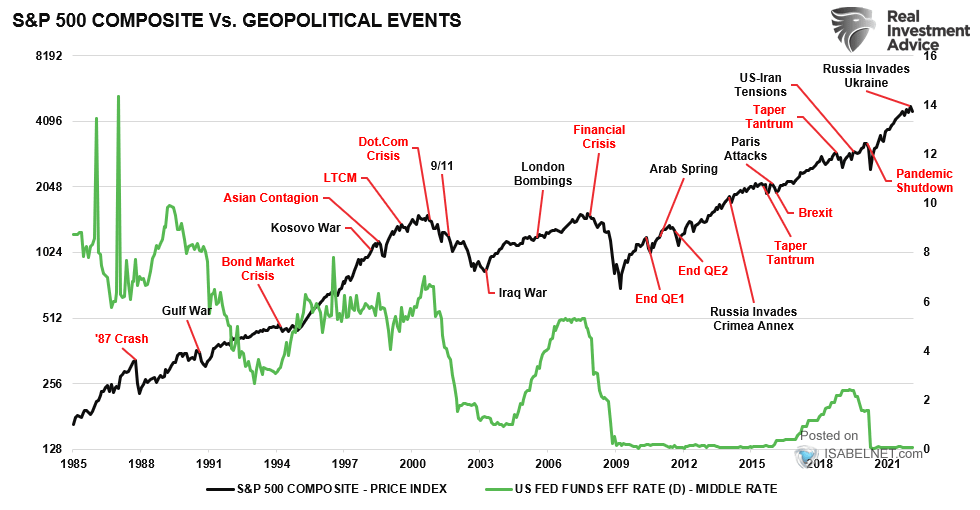

The situation in Ukraine made me reflect on how geopolitical events influence financial markets. One of the most useful tools for understanding these dynamics is historical analysis, particularly the LPL Research chart, which shows the S&P 500’s reaction during major geopolitical shock events over the last decades.

What stands out from this analysis is clear: wars and geopolitical shocks can create turmoil in financial markets, but historically, they have never led to the end of the stock market. Sure, there are moments of intense volatility, but the market has always had the ability to recover. Crises, while painful and destabilizing, are part of the cyclical nature of markets.

The interesting fact, however, is that the emotional reaction caused by these events remains similar over time. Fear, uncertainty, and instability drive mass sell-offs, but that does not mean the market crashes permanently. In fact, looking at past events, we can see that the market, despite initial turbulence, has always rebounded. Therefore, although no one can predict with certainty what will happen in the future, history teaches us to reason rationally rather than follow the emotional impulse of the moment.

The Lesson of Human Progress: Investing with Rationality

Geopolitical crises show us the resilience of society and human economies. History teaches us that, despite the initial chaos, opportunities for growth and progress never stop. Over the long term, the market has always reacted to crises with innovation, adaptation, and, above all, a desire to overcome adversity.

Take past wars as an example: World War II, the Vietnam War, or even the 2008 financial crisis. In all of these cases, the market reactions were initially severe, but eventually, the economy recovered and continued to grow. It is essential to remember that humanity has an extraordinary capacity for renewal, and this is something investors need to keep in mind.

History teaches us that the odds are in our favor when we bet on creativity, technological progress, and resilience. The war in Ukraine, sadly, is an example of how devastating geopolitical events can be, but also of how, in the long term, the adaptability of markets and global economies can transform these challenges into opportunities for growth.

Geographic Diversification: Protection Against Shocks

Another crucial lesson that emerges from situations like the Russian invasion of Ukraine is the importance of geographic diversification in investments. When the Russian stock market collapsed by 50% on February 24, 2022, the negative effects were felt immediately. However, the losses were not universal, and diversification played a key role in mitigating the impact.

To provide a concrete example, Russia accounted for 0.38% of the MSCI All World Index and 2.99% of the MSCI Emerging Markets Index. This means that even if the Russian economy had completely collapsed, the total loss for global investors would have been limited to 0.38% in one case and 2.99% in the other. This example underscores the importance of having a well-diversified portfolio geographically, to limit the impact of isolated events that may trigger strong turmoil in a specific region.

Geographic diversification is not only a prudent strategy; it is a real form of protection against uncertainty. When a local market experiences severe shocks, other sectors or geographic areas may still perform positively, compensating for the losses. History teaches us that events like wars, political crises, or economic shocks have a limited impact if the portfolio is well-balanced across different regions and sectors.

Conclusion

Looking back at these three years, we can see how the stock market, despite the initial difficulties caused by the Russian invasion of Ukraine, is slowly recovering. Resilience and the ability to adapt are intrinsic characteristics of markets, and our role as investors is to navigate uncertainty with rationality, keeping in mind the lessons of the past. Geographic diversification is a fundamental strategy for protecting your portfolio and handling periods of turbulence.

The future is never certain, but with proper planning, we can be better prepared to face it with greater confidence, knowing that hardships, no matter how significant, are never meant to last forever.