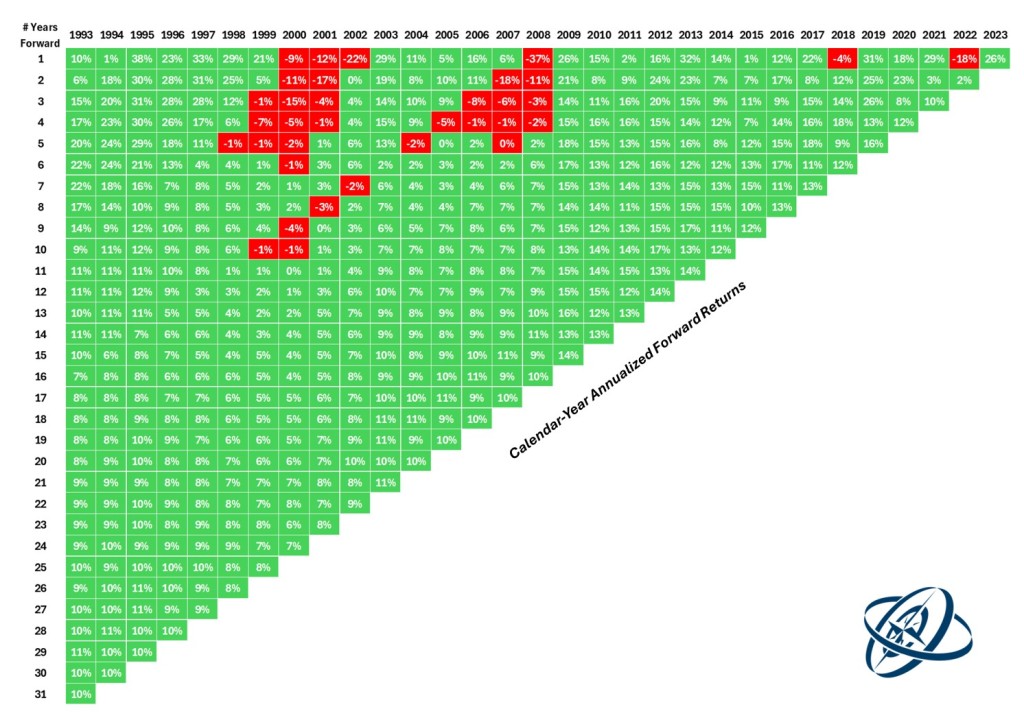

One of the most insightful graphs for anyone interested in investing shows the annualized returns of the S&P 500 from various starting points. It acts as a time map, revealing year-by-year what would have happened to your capital if you had invested at a given point and left your money to grow for 1, 3, 5, 10, or 20 years. It’s a vivid snapshot of just how crucial time is in the world of investing.

Let’s take an example: If you had started investing in 2005, you would have achieved an average annual return of 3% after six years and 8% after ten years. These numbers tell different stories depending on your perspective: a weak decade or one defined by resilience. What stands out, however, is the dominance of green on the graph. In the vast majority of cases, the longer you invest, the better the returns. This isn’t just a motivational slogan—it’s the proven strength of the stock market over time.

When Does “Long-Term” Really Become Long-Term?

In financial theory, 10 years are often considered “long-term”. But in real life, 10 years can feel like a lifetime. It’s the time that separates a thirty-year-old from a forty-year-old, a recent graduate from a seasoned professional, or someone without children from a parent. In a decade, everything can change. Yet, in finance, 10 years might not be enough.

The stock market can be brutal in the short term. There have been periods over the past century where even the world’s most renowned index, the S&P 500, delivered negative or almost zero returns. Anyone who invested everything at the wrong time and endured two consecutive crashes would have seen their investments suffer greatly. However, looking beyond 15 years, there has never been a period in modern history where the returns were negative.

Over 20 years, the annual return of the S&P 500 has always ranged from 6% to 10%. In other words: the risk of loss diminishes with time, and so does the anxiety over entering the market at the “wrong” moment.

Time Matters Much More Than Timing

Many investors, especially at the start, obsess over “when to enter.” They wait for a market crash, fear a peak, and analyze charts as if they hold prophetic power. But when the time horizon is long, the exact moment you enter matters far less than how long you remain invested.

For instance, the worst annual return in one year was -37%, and the best was +38%. Over five years, the range tightens to -2% versus +18% annually. After ten years, it spans from -1% to +17%. After twenty years, all the returns are positive.

This tells us that the most important factor isn’t the day you invest, but how long you stay invested.

You Don’t Need Exorbitant Returns

An often-overlooked aspect of investing is that not everyone needs to chase high returns. The goal isn’t to outperform the market but to achieve your financial goals while minimizing stress and effort.

For example, if you have €100,000 and need it for a trip or another short-term goal, investing in a money market ETF offering around 3.5% per year is perfectly sufficient. Secure and stable.

On the other hand, if you have €1,000,000 and are aiming for a steady income, a modest 4% return would generate €40,000 annually—enough to cover a comfortable standard of living without major surprises.

But if you’re young, with low initial capital, high saving potential, and a long time horizon (20-30 years), accepting volatility and investing primarily in stocks makes sense. It’s in these years that returns accumulate, and time becomes your best ally.

The Secret? Planning

Good financial planning isn’t just about plugging a 7% return into a compound interest calculator and seeing how much you’ll have in 30 years. It’s about asking yourself:

- What returns do I really need?

- When will I need the money?

- How much volatility can I tolerate without losing sleep?

- Can I afford to “forget” about this investment for 15 years?

The answers to these questions will guide your decisions: asset allocation, time horizon, and the right instruments for your goals.

Conclusion

The stock market remains the cornerstone for long-term investors. However, the definition of “long-term” is subjective and depends on personal circumstances. For some, it’s 10 years, for others 30. What matters most is understanding where you are in your life’s journey and adjusting your strategy accordingly.

Rather than striving for the perfect market entry, focus on finding the right balance between time, goals, and peace of mind.