In the world of investing, the concept of risk is ever-present. We hear about it in terms of performance, management, measurement, and strategies. Often, when thinking about how to manage investments, investors tend to focus too much on mathematical and quantitative metrics such as standard deviation, value-at-risk (VaR), or the well-known Sharpe ratio. While these tools are useful for financial analysts, the true heart of risk management lies in a much more personal and subjective concept: your risk tolerance.

Risk isn’t just a mathematical calculation; it’s also about the ability and willingness to take on risk. Every investor has a different perception of risk, which reflects not only the types of assets they invest in but also their emotional and psychological responses to market movements. Understanding your risk tolerance is critical to developing an investment strategy that meets your long-term goals without keeping you awake at night.

The Nature of Risk: More Than a Mathematical Issue

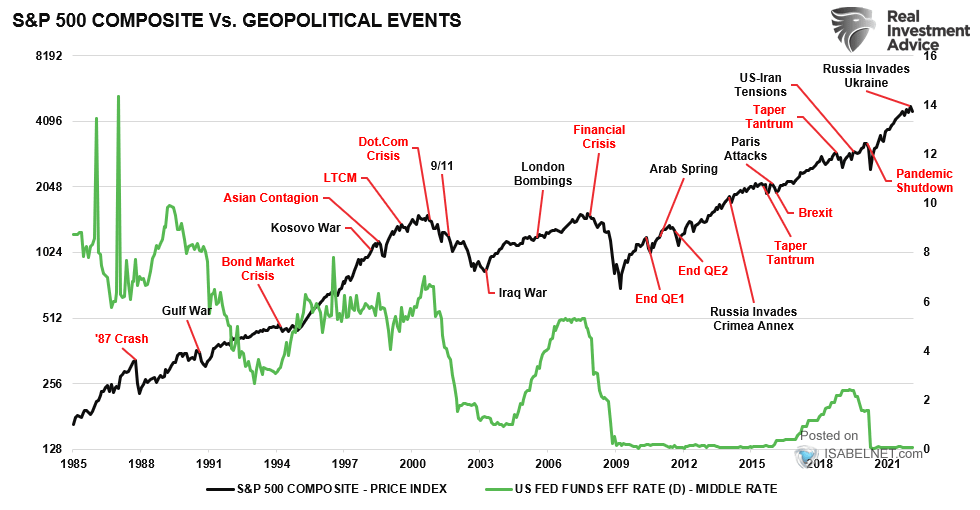

Financial risk can be defined as the uncertainty about the future returns of an investment. While tools like Monte Carlo simulations or standard deviation analysis may provide statistical insights into the likelihood of gains or losses, they can’t predict the unpredictable. The greatest risk is always the unknown—the uncertainty every investor must deal with. No matter how sophisticated the analytical tools are, there’s always an element of risk that remains out of sight.

There are three categories of risk in investment theory: the “known-knowns”, the “known-unknowns”, and the “unknown-unknowns”. These concepts help us understand that, despite all the technology and economic forecasting, the future is inherently unpredictable. Investors, therefore, can never be completely prepared for every eventuality. The only aspect we can exercise direct control over is our approach to risk management.

Risk Tolerance: Capacity vs. Willingness

When talking about risk tolerance, it’s important to distinguish between your capacity to take on risk and your willingness to do so. Capacity is based on objective factors such as age, net worth, income, future earnings potential, and your investment horizon. A young professional, for example, has a greater capacity to take on risk since they have a longer investment horizon and can afford to recover from any potential losses.

However, your willingness to take on risk is a different matter. Even if you have the capacity to bear higher risk, you may not feel comfortable doing so. Your emotional tolerance for risk may dictate your investment choices. Some investors may prefer a more conservative strategy to help them sleep better at night.

It’s important to find a balance between your ability to take on risk and your comfort level. While you may think that holding cash in a savings account is risk-free, inflation can erode your purchasing power, which could jeopardize your ability to meet long-term financial goals.

The Types of Risks You Should Consider

When you invest, you face various types of risk, which manifest in different ways. The key risks to be aware of are:

- Permanent loss of capital: The possibility of losing your investment irreversibly. This is one of the most severe risks, as there is no way to recover a permanent loss.

- Downside risk: The risk of losing more than you are emotionally or financially prepared to handle.

- Upside risk: The fear of missing out on potential gains. In other words, the risk of not capturing growth opportunities.

- Loss of purchasing power (inflation): Inflation diminishes the real value of money over time. Even if the nominal value of your portfolio increases, inflation can erode your purchasing power, undermining your long-term goals.

- Failing to reach your financial goals: This is the most impactful risk because failing to achieve your goals (such as retirement or funding education) has a direct effect on your quality of life. This type of risk is far more damaging than the volatility of returns.

Risk Tolerance: How to Evaluate It

Determining your risk tolerance involves considering two primary factors: your ability and your willingness to take on risk. Your ability is measured through objective indicators such as income, net worth, age, and investment horizon. Your willingness is a more psychological aspect and depends on how comfortable you are with market volatility.

If you’re young and have a long-term investment horizon, your capacity to take on risk will be higher. Also, you can assume that your income will rise over time, so you’ll have the ability to replenish any losses through increased savings. However, if you’re nearing retirement, you will need to adjust your portfolio to reduce risk and protect your capital.

Strategies for Managing and Reducing Risk

Since risk can never be fully eliminated, it’s crucial to have a strategy to manage it effectively. Here are some key strategies that can help reduce risk over time:

- Have a solid investment plan: This includes setting clear goals and devising a strategy for how you will react to different market scenarios. Writing it down allows you to review it when tempted to make irrational short-term decisions.

- Diversification: Spread your investments across different asset classes, geographies, and sectors. While diversification won’t guarantee huge returns, it will help you avoid catastrophic losses.

- Asset allocation: This is the mix of stocks, bonds, real estate, cash, and alternative investments in your portfolio. Your asset allocation has a much bigger impact on your returns than any individual stock or fund you choose to invest in.

- Rebalancing: Regularly rebalancing your portfolio forces you to sell winners and buy losers to maintain your target asset allocation. Doing this periodically ensures that you remain aligned with your stated risk parameters.

- Dollar-cost averaging (DCA): DCA is a strategy that helps you invest periodically over time to reduce the risk associated with market timing. It allows you to spread your purchases over a longer timeframe, making market volatility work in your favor.

- Aligning investments with your time horizon: Each financial goal comes with its own time horizon. Short-term goals (e.g., emergency savings) should have lower-risk investments, while long-term goals (e.g., retirement) can afford higher risk in exchange for potential growth.

- Control your emotions: Putting your finances on auto-pilot and avoiding the temptation to time the market is essential. Having a well-thought-out plan will also help you stay away from the vicious cycle of fear and greed.

- Keep it simple: Simple strategies are often the most effective. Avoid complex products or strategies that you don’t fully understand. This alone will help you avoid unnecessary risk and likely lower your costs.

- Save more: The more you save, the lower your risk of not achieving your goals. Increasing your savings reduces your exposure to potential losses and helps you stay on track.

Conclusion

Investing is a marathon, not a sprint. Acknowledging that we cannot predict the future and that there will always be unknown risks is an essential step toward managing your emotions and minimizing unnecessary risk. Risk tolerance is the first step in crafting a successful investment strategy that works for you—one that aligns with your goals, limits unnecessary anxiety, and increases the likelihood of success in an unpredictable world.