Investing should be a rational act. And yet, throughout history, human behavior in the markets has been anything but. Greed and fear alternate like tides, and today, one of the most dangerous emotional triggers for investors goes by a modern acronym: FOMO, the Fear of Missing Out. It’s a timeless instinct, but in today’s hyper-digital environment, it has evolved into a subtle but powerful threat—one that can turn even the most cautious saver into an unsuspecting victim.

What FOMO Really Means in Investing

FOMO in investing is the emotional urge to act quickly for fear of missing out on a supposedly unrepeatable opportunity. It’s not driven by financial analysis or macroeconomic outlooks—it’s sparked by rising charts, euphoric online chatter, and the feeling that everyone else is cashing in on something huge.

Platforms like Reddit, X, TikTok, and YouTube amplify this sensation. Seeing others seemingly profit in real time, while you sit on the sidelines, creates anxiety. And the only thing that seems to soothe it? Acting—buying now—before it’s too late.

The Perfect Environment for Fear of Being Left Behind

Never before has information moved faster than our ability to process it. Social platforms turn every opinion into a trend, every rumor into a headline, every stock into a once-in-a-lifetime opportunity. The result? A marketplace driven more by noise than knowledge, where the loudest voice often wins, regardless of substance.

Accessing markets no longer requires a broker or financial advisor. All it takes is a smartphone and a debit card. While this has democratized investing, it has also left many without the tools—or the discipline—to navigate complexity and volatility.

How FOMO Can Damage Your Portfolio

FOMO distorts investment behavior in several dangerous ways:

- It leads people to buy into already-overpriced assets, fueling speculative bubbles.

- It causes portfolios to become dangerously concentrated in a few high-flying names.

- It encourages frequent, impulsive changes to investment strategy—often at the worst times.

The numbers tell a hard truth: those who chase trends or try to time the market tend to underperform long-term investors with patience and discipline. The history of finance is filled with cautionary tales—GameStop, AMC, Dogecoin, or even various tech and green stocks driven by hype rather than fundamentals.

When GameStop Becomes a Case Study

In January 2021, GameStop went from struggling retailer to stock market sensation. Online communities like WallStreetBets orchestrated a coordinated buying spree, driving the price from a few dollars to over $120 in a matter of weeks. But those who bought at the top quickly watched their gains evaporate when the price fell back down.

GameStop wasn’t an isolated case—it was a pattern. The same dynamics repeated with different names, always ending the same way: with the last ones in holding the bag.

Who’s Most Affected by Financial FOMO?

New, young investors. People with little financial education. Users deeply immersed in social media. These groups are particularly vulnerable to FOMO.

Why? Because FOMO doesn’t just play on greed—it feeds on the need for social validation. In a world where likes, followers, and stories of success are currency, not participating in the latest trend feels like failure. Add to this the classic herd mentality—the more people do something, the more it seems like the right move—and you’ve got a recipe for collective irrationality.

How to Defend Yourself Against FOMO in Investing

1. Recognize the Problem

First, acknowledge that FOMO is real—and dangerous. Learn to filter the noise and separate entertainment from actual investment insight.

2. Commit to Ongoing, Multidisciplinary Learning

Successful investors study markets, industries, and company fundamentals. But they also study human psychology. Knowing your emotional triggers is half the battle.

3. Set Clear, Non-Negotiable Rules

Discipline protects you from yourself. Some useful guidelines:

- Never invest more than 5% of your portfolio in a single stock.

- Maintain diversification across asset classes.

- Avoid making decisions based solely on unsolicited advice or internet hype.

4. Respect the Value of Time

A good investment idea today will still be good next week. If it only works in the heat of the moment, it’s not an investment—it’s a gamble.

5. Cool Down Your Emotions

Some investors implement mandatory reflection periods—three days, a week, even a month—before executing high-risk trades. Time helps enthusiasm settle and logic resurface.

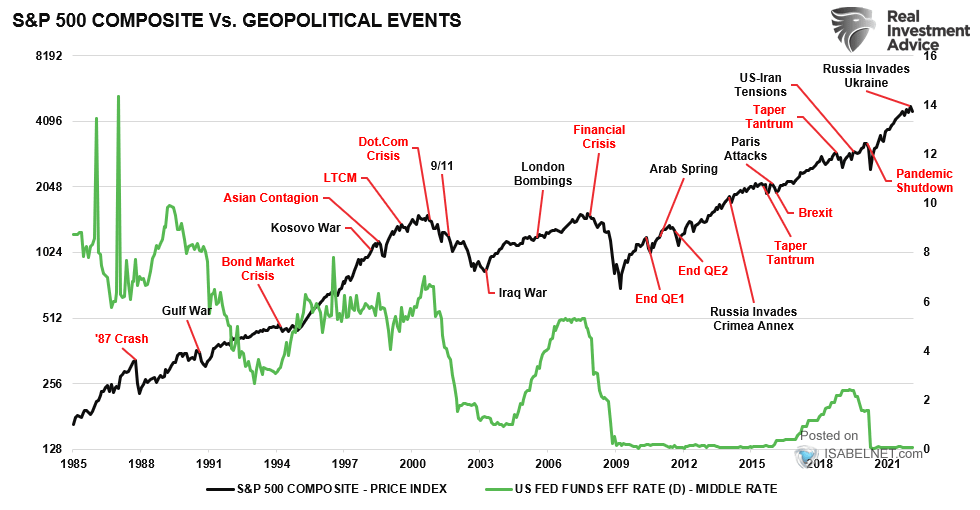

Not Everything That Goes Up Is Built to Last

History teaches us that bubbles are eternal, even if the packaging changes. From the Dutch tulip mania in the 1600s to the dot-com boom of the 1990s, every generation has chased irrational dreams—and paid the price.

Social media has sped up these cycles, but it hasn’t changed their nature. Ultimately, true investments generate value over time, not overnight.

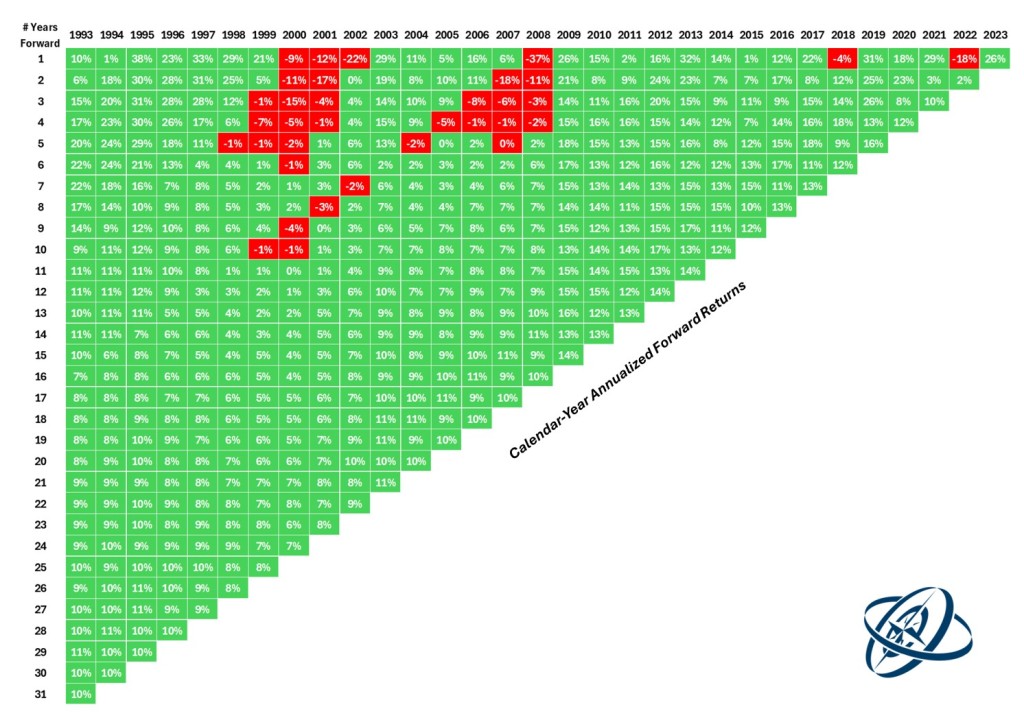

The Patient Investor Always Wins

Those who build solid financial plans—rooted in long-term goals and clear strategies—are less likely to get swept away by passing trends. Not because they’re resistant to change, but because they know where they’re going.

Patience, in investing, is a competitive advantage. The market rewards those who resist temptation, who are willing to let go of today’s hype in favor of tomorrow’s real returns.

Conclusion

Markets will always be full of noise. Full of voices promising easy money, quick wins, and massive upside—if only you act now. Resisting these siren calls takes mental strength and clarity of purpose.

FOMO is the perfect trap for those seeking thrills, not results. But investing isn’t an adrenaline rush—it’s a marathon. And those who remember that, especially when the crowd runs the other way, gain an edge no algorithm or viral trend can ever replicate.