Warren Buffett, one of the wisest and most successful investors in history, has consistently shared his strategies and philosophy for building wealth. His quotes are timeless pearls of wisdom that not only help understand how to approach investments but also offer life lessons applicable to many aspects of our lives. In this article, I have selected seven of his most famous quotes and analyzed them, relating them to current economic developments and the opportunities we can seize today.

1. “The stock market is simple: buy shares of a great company for less than their intrinsic value. The company should be run by competent and honest managers. Once you’ve done that, hold the shares forever.”

According to Buffett, the key to investment success is purchasing high-quality companies at a reasonable price and holding on to the shares for the long term. In a market that tends to favor short-term investing and frantic trading, Buffett encourages us to adopt a long-term investment strategy focused on intrinsic value and competent management. Today, with increasing access to financial analysis and corporate performance data, the question is: how can we identify a good deal in a rapidly changing market? The answer lies in seeking solid management and having the patience to allow the company to grow over time.

In this article, I also discussed alternative strategies for evaluating companies to invest in.

2. “Investing must be rational: if you don’t understand it, don’t do it.”

Buffett reminds us that knowledge is power: without fully understanding an investment, we should never take the plunge. The most common mistake is getting swept up in the latest trend, as is often the case with popular stocks or cryptocurrencies. The importance of only investing in what you truly understand is more crucial than ever today, when markets are filled with complex assets that are difficult to analyze without a solid background. Buffett’s advice is to avoid blind greed and make decisions based on a strong understanding of the businesses and assets we invest in.

3. “It’s better to be approximately right than precisely wrong.”

It’s okay to be informed, but there’s no need to have all the perfect and precise information (which, by the way, is very hard to come by). This quote teaches us that action is often more important than perfection. In the world of investing, the error of striving for perfection can be more harmful than a rough estimate. If we wait too long to obtain “certainty” on every single detail, we might miss the boat. Acting with a reasonable approach and accepting a margin of error is far more effective than endlessly searching for precision. Patience is key to avoiding decision paralysis and making choices that, while not perfect, are sufficiently right.

4. “The first rule is not to lose. The second rule is not to forget the first rule.”

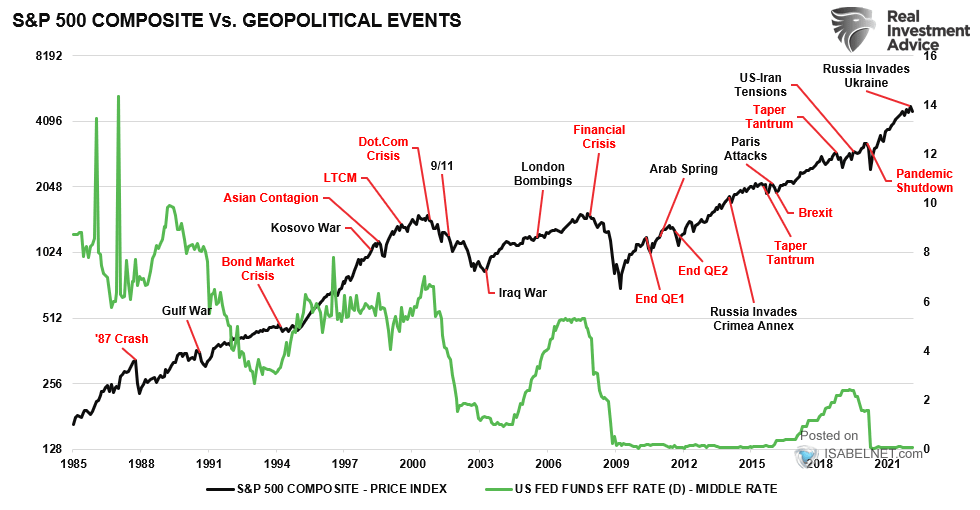

This quote underscores the importance of protecting capital. Buffett highlights that diversification is one of the best techniques to reduce risk. During events like the 2008 financial crisis, when many investors suffered devastating losses, Buffett demonstrated that prudence and risk management are essential to navigating the turbulent waters of the market. While diversification might reduce potential returns, it helps protect against unforeseen events—the so-called “black swans.” Without diversification, we risk seeing our capital wiped out due to a single mistake.

In this article, I also touched on a particular type of diversification, geographical diversification.

5. “Be greedy when others are fearful, and fearful when others are greedy.”

Buffett’s words capture one of the most powerful concepts of contrarian investing. Markets are often driven by emotions: fear during crises and greed during booms. Buffett encourages us to exploit these collective emotions: buy when others are selling out of fear, and sell when everyone is swept up in euphoria. During the 2008 financial crisis, Buffett made bold bets on the market’s recovery, profiting immensely when others were paralyzed by fear. The lesson here is that the contrarian investor often finds incredible opportunities when the market is most fearful.

In this article, I also discussed this topic.

6. “In business, the best thing to do is the simplest thing, but doing it is always very difficult.”

Buffett warns us that while simplicity is key to business success, it’s often difficult to execute. Too often, investors and entrepreneurs are tempted by complex strategies or projects that seem promising but end up in confusion. Investing in solid companies, buying at reasonable prices, and maintaining a diversified portfolio are all actions that are simple to understand but require discipline to implement. The real difficulty lies in staying true to these rules without being distracted by the complexity and noise of the market.

Do you remember what the Super Bowl taught us?

7. “It takes just as little time to see the positive side of life as it does to see the negative side.”

Buffett reminds us that a positive attitude is a powerful asset, especially in challenging times. During the 2008 crisis, Buffett chose to bet on the recovery. When asked why he was so optimistic, he simply replied that there was no alternative: either he would win (and make a lot of money), or capitalism would collapse and money would lose its value. Choosing to remain optimistic and invest in the recovery wasn’t just the right move—it was the only sensible one. Having a positive mindset allows us to spot opportunities even in the toughest times. It helps us react proactively and look toward the future with hope, rather than being overwhelmed by fear and uncertainty.

In this article, I talked about the importance of staying rational, and thus optimistic, even in the worst of times.

Conclusion

Warren Buffett’s quotes serve as an indispensable guide for anyone who wants to understand the fundamental principles of investing and financial success. His philosophy is rooted in rationality, patience, optimism, and diversification. Investing in solid companies at reasonable prices, holding a portfolio for the long term, and knowing how to seize opportunities when others are fearful are lessons that remain valid in today’s financial landscape.

If you resonate with this philosophy, you can start implementing these strategies and, as Buffett says, “being approximately right” is far better than being precisely wrong.