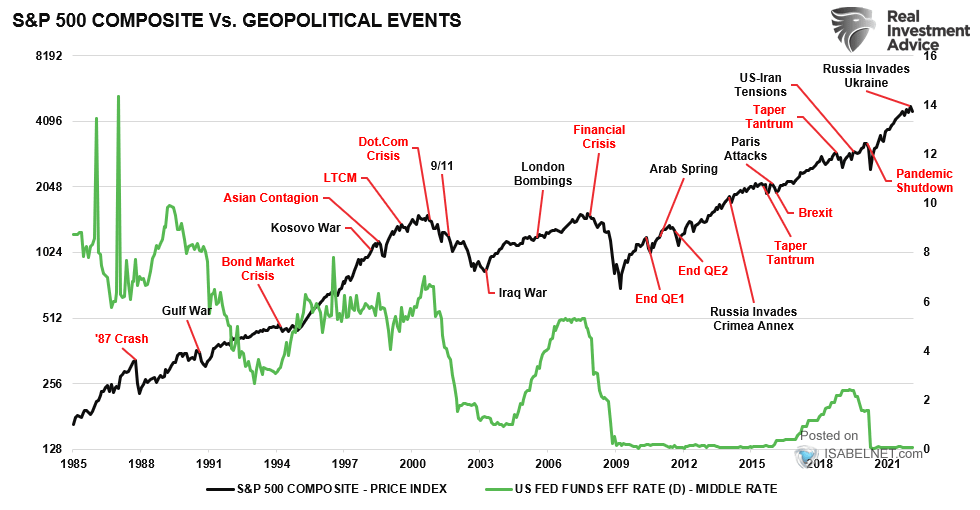

In an era defined by economic uncertainty, persistent inflation, and rising geopolitical tensions, gold is once again asserting itself as a strategic asset for both individual and institutional investors. The year 2025 marks a pivotal moment for the yellow metal—not just for its price performance, but for its renewed role as a hedge against market volatility and a tool for portfolio diversification.

Why Gold is Gaining Momentum in 2025

Global central banks are facing a delicate balancing act. While inflation remains above targets, slowing growth and fragile markets demand monetary easing. In this environment, investors are seeking stable, uncorrelated assets that preserve purchasing power.

As a result, demand for gold is on the rise. Central banks—particularly in Asia and Latin America—are reducing their reliance on the US dollar by increasing gold reserves. Simultaneously, retail investors are returning to gold as a hedge against fiat currency depreciation and market shocks. These forces have contributed to record-high prices in the first quarter of 2025.

How to Invest in Gold: The Main Options

1. Physical Gold: Tangible Value with Practical Limits

Buying physical gold (bars or coins) is the most traditional method of investment. It offers direct ownership and protection from currency devaluation and systemic risks. However, it comes with downsides: storage, insurance, no passive income, and potentially limited liquidity.

For long-term preservation, mid-sized bars (e.g., 50g or 100g) strike a good balance between cost efficiency and ease of resale.

2. Gold ETFs: Efficient Market Exposure

Gold ETFs (Exchange Traded Funds) offer an accessible, low-cost way to gain exposure to gold prices. They trade like stocks and require no storage or handling of the physical metal. However, investors should be aware that not all ETFs are backed by actual gold—some are derivatives-based.

In 2025, the best strategy is to focus on physically backed gold ETFs stored in audited vaults. Top options include SPDR Gold Shares (GLD) and Invesco Physical Gold (SGLD).

3. Gold Mining Stocks and Funds: Higher Risk, Higher Reward

Investing in gold mining companies provides an indirect exposure to the gold price, often with leverage on upward movements. While potentially more profitable, this strategy also involves higher volatility and company-specific risk.

Diversification is essential—consider gold mining ETFs like VanEck Gold Miners (GDX) or VanEck Junior Gold Miners (GDXJ) to spread risk across the sector.

Common Mistakes to Avoid When Investing in Gold

- Chasing prices at peak levels: Gold is a long-term hedge, not a short-term speculation.

- Ignoring currency effects: For non-USD investors, exchange rate volatility can impact returns.

- Investing without a clear strategy: Without defined objectives, gold may underperform or act counterproductively.

How Much Gold Should You Hold in Your Portfolio?

The optimal allocation to gold depends on the investor’s profile and existing asset mix. Most modern portfolio theories suggest a gold allocation between 5% and 15%, depending on:

- Risk tolerance

- Exposure to cyclical or fiat-based assets

- Views on inflation and macroeconomic risk

Some investors use a tactical approach: increasing gold holdings in times of market stress and reducing exposure during periods of stability.

The Strategic Role of Gold in Modern Portfolios

Gold should not be seen as a speculative bet, but as a strategic insurance policy. In a world where “normal” is increasingly unstable, gold offers resilience. When properly integrated into an investment strategy, gold can:

- Preserve capital during inflationary cycles

- Reduce portfolio volatility

- Hedge against systemic shocks

In 2025, investing in gold means taking control of your financial security—beyond trends, beyond hype, and with a long-term view.