In 1993, Richard Gott, a renowned and often controversial astrophysicist, published an article titled “Implications of the Copernican Principle for Our Future Prospects.” In this piece, Gott ventured to calculate the probable duration of the human race before its inevitable extinction. However, what makes this article particularly interesting, even today, isn’t just the boldness of his predictions but the methodology he used to estimate the future based on the past. This concept, which he outlined in the article, has far-reaching implications—particularly in the world of finance.

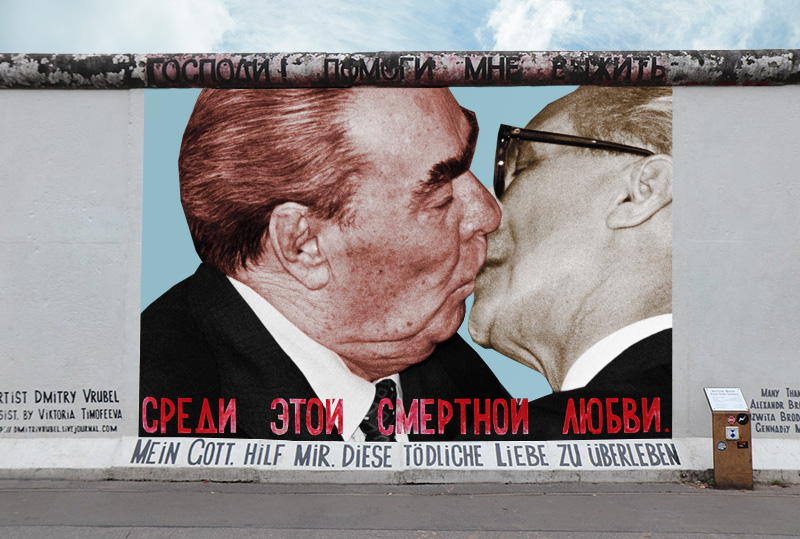

The origin of Gott’s research traces back to 1969, when the 23-year-old recent Harvard graduate visited Berlin. At that time, the Berlin Wall had been erected just eight years earlier, in 1961. During his trip, Gott had also recently visited the ancient site of Stonehenge, and this led him to wonder whether the Berlin Wall would endure for as long as the British neolithic monument.

To answer this question, Gott applied the Copernican Principle—a philosophical idea from astronomy that suggests the Earth does not occupy a privileged position in the universe, but is merely one of many planets orbiting the Sun. Gott extended this thinking to time itself. In essence, he reasoned that no point in time is inherently special or exceptional, just as no location in the universe is unique. In the same way that the Earth is not “special” in its orbit, we humans live through time in an arbitrary moment of a larger phenomenon’s life cycle.

This line of reasoning led him to create a simple formula to estimate the future survival of a phenomenon based solely on how long it had already existed. The key takeaway from his equation is that a phenomenon’s survival prospects increase the longer it has persisted. In the case of the Berlin Wall, Gott calculated that, at the time of his visit, the Wall was eight years old. There was a 50% chance that it would collapse between 1971 and 1993, meaning it had about 50% chance of survival up until that year. As we now know, the Wall did indeed fall in 1989—making Gott’s prediction uncannily accurate.

From this exercise, Gott developed what is now called the Lindy Effect. This principle states that the longer something has been around, the greater the likelihood it will continue to exist in the future. For example, a book that has been in print for 50 years may have a better chance of being around for another 50 years, as its survival rate improves the longer it has endured.

The Lindy Effect is not confined to physical structures or historical events; it can be observed in many areas, including ideas, technologies, and even businesses. In the world of business, for example, the longer a company has been successfully operating, the more likely it is to continue thriving in the future. This could be a useful lens for investors to apply when selecting companies to back, as companies with a long history of market resilience may be more likely to withstand future challenges.

How the Lindy Effect Can Shape Investment Decisions

When evaluating potential investments, it’s worth considering the Lindy Effect. Companies that have stood the test of time, whether through economic downturns, technological changes, or societal shifts, are often better positioned to survive future disruptions. Their ability to adapt and persist can be an indicator of their future resilience.

For instance, think about some of the world’s oldest and most successful companies, such as Johnson & Johnson, Coca-Cola, or Procter & Gamble. These companies have not only survived for decades—they’ve thrived. The reason for this longevity isn’t just luck. These organizations have established strong brands, efficient operations, and a history of adapting to new challenges. As a result, their survival odds, according to the Lindy Effect, are considerably higher than younger, less-tested companies.

While past performance is never a perfect predictor of future success, the Lindy Effect suggests that companies with long histories of stability and growth are likely to continue performing well in the future. In addition, understanding the factors that have helped such companies endure can offer insights into their future strategies and help investors make more informed decisions.

Conclusion

The Lindy Effect, introduced by Richard Gott through a fascinating blend of astrophysics and practical reasoning, provides an interesting perspective on longevity and survival. In both the physical world and in business, the longer something has existed, the more likely it is to continue existing. For investors, this principle could be a powerful tool to evaluate potential investments, guiding decisions based not just on a company’s current performance, but also on its historical resilience. The next time you’re considering an investment, think about its age, its track record, and its capacity to endure—because, according to the Lindy Effect, that may very well be the best indicator of its future success.